Pesquisar

POSITIVE OUTLOOK FOR MACAO’S BANKING SECTOR

Interview with Pedro Cardoso, CEO of BNU

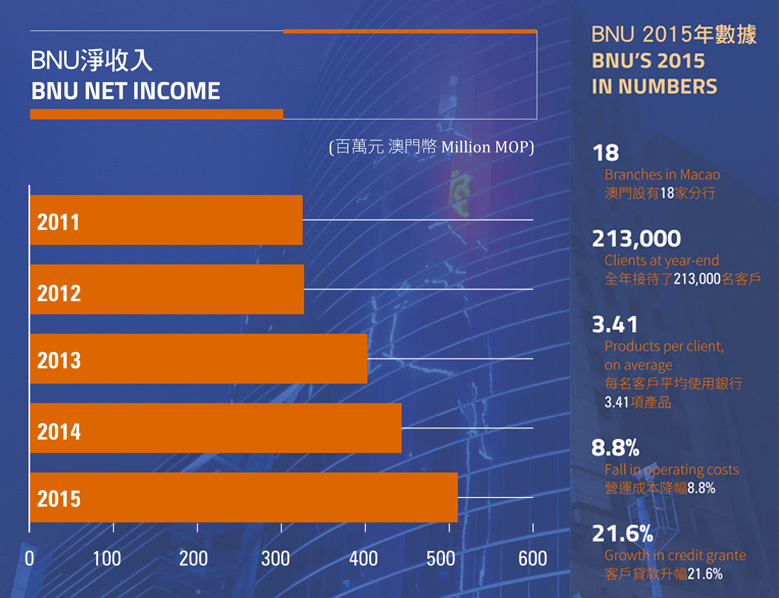

Banco Nacional Ultramarino S.A. (BNU), one of Macao’s note-issuing banks, picks the best opportunities offered by the health of the city’s financial system to keep growing, BNU Chief Executive Pedro Cardoso says. The bank’s business grew by about 22 percent last year, propelled by more lending, in particular to retail customers and to small and medium enterprises (SMEs).

Mr Cardoso told Macao Image in an interview that BNU, part of the Portuguese group Caixa Geral de Depósitos S.A. (CGD), was now taking advantage of the opportunities arising from the prospect of more business between Mainland China and Portuguese-speaking Countries. He said the bank was an important conduit for entrepreneurs in Portuguese-speaking Countries seeking to enter the Mainland Chinese market, and for Chinese enterprises wishing to invest in Portuguese speaking Countries.

BNU reported a 15 percent increase in net income in 2015, attributed to growth in lending to retail customers and SMEs. Was this growth within your expectations?

The business results for 2015 met our expectations. The results last year followed the same path as in previous years. We’ve recorded growth in terms of net income of about 15 percent, while the average for the previous three years was about 16 percent. This comes as a result of the restructuring done within the bank in terms of division of its business into separate segments – for example, SME business and retail banking business. It also reflects the less positive economic background in Macao in 2015. So, on one hand, we had positive internal results but, on the other hand, we had to deal with a less positive economic framework. Putting the two together, I think our achievement in 2015 – growth of 22 percent in terms of business volume and of 15 percent in terms of net income – is quite reasonable.

What are the segments that BNU operates in?

BNU works in five business segments: retail banking, private and institutional banking, SMEs, large companies, as well as gaming and hospitality. For each segment we have developed specific products and services, and we have developed different groups of products and services, trying to entice customers to deal with us not through only one product but through bundles of products and services. For each segment we have dedicated teams, especially for SME and retail banking business. We have been investing quite a lot in these segments, not only in terms of increasing the number of staff and their training, but also by having more tools and strong marketing of our offerings.

BNU works in five business segments: retail banking, private and institutional banking, SMEs, large companies, as well as gaming and hospitality. For each segment we have developed specific products and services, and we have developed different groups of products and services, trying to entice customers to deal with us not through only one product but through bundles of products and services. For each segment we have dedicated teams, especially for SME and retail banking business. We have been investing quite a lot in these segments, not only in terms of increasing the number of staff and their training, but also by having more tools and strong marketing of our offerings.

Which of the bank’s segments posted faster growth in 2015?

Business volume in the SME segment grew by about 30 percent last year. In fact, in the last few years, SME business always grew at a much faster pace than the bank’s other businesses. The volume of the bank’s retail banking business also grew slightly faster than the average.

Does BNU have plans to expand its operations?

Our expectation is that we will have 20 branches by the end of the year in Macao. We have also asked for a licence from the Chinese authorities for a branch on Hengqin Island, which is likely to open in the fourth quarter of this year or the first quarter of 2017.

How much progress have you made toward setting up the Hengqin branch?

Internally, we have done most of the work, from rules and procedures to hiring of staff, from the development of our product and service offerings, to the development of the IT system. We have been working hard in all these areas and we are almost ready in several of them.

What will be the focus of the Hengqin branch?

We have a simple strategy. Through the Hengqin branch we aim to provide services to BNU customers that operate frequently in the Guangdong province. We have hundreds, if not thousands, of customers that have investments in Guangdong: from factories to service companies, and individuals that have property investments there. So we want to extend our relationship with those customers from the Macao SAR to Guangdong. On the other hand, our banking group, CGD, also has a strong presence in Portuguese speaking Countries, and we want to use that presence to help develop the economic trade and investment relationship between Mainland China and Portuguese-speaking Countries. Only with a presence in Mainland China can we be more active in promoting business between Mainland China and Portuguese-speaking Countries

What new products and services has BNU introduced?

Last year was quite a fruitful year for BNU in terms of new products and services. I would say the most visible was the first Asia Miles card in Macao. It’s not the first miles card in Macao but is by far the best in terms of benefits. It offers benefits that can be used for air travel all over the world, as well as in hotels and restaurants. It’s a good proposition for our customers, since a high percentage of our customers are frequent travellers. We have also launched – for customers that travel often in Macao, Hong Kong and Mainland China – a UnionPay triple-currency card, which provides customers with an efficient method of payment, because when they do transactions with that card they don’t incur foreign exchange costs – which can be quite hefty in some cases. The reason for launching such a card is that while our credit card business is growing at an average annual rate of about 10 percent, the usage of our credit cards in Mainland China and Hong Kong is growing at about 30 percent. So we needed to find a good proposition for people that use our credit cards there. Also in 2015, we launched a mobile banking service, covering transactions – a service which, we expect, will grow significantly in the years to come. On our online banking platform we have launched a service through which a customer can reserve a foreign currency online – again, thinking about our Macao customers that are frequent travellers and that often need foreign currency.

How has the UnionPay triple-currency card performed?

It’s a very successful product, like the Asia Miles card. This year we expect to consolidate those projects and further promote these cards among our customers and Macao residents. I would say that in both cases they’re performing above our expectations.

Your bank says its business arising from dealings with Portuguese-speaking Countries grew by 153 percent in 2015. How have you developed this business segment?

To develop such business successfully, we need to meet two conditions. First, we need to have the correct strategy, the right people and right structure to develop this business, which we have. We have a dedicated team just to handle this kind of business. They don’t handle the business direct, but support our commercial divisions so that they are focused on this type of business, and also liaise with our banking group. Second, we need support from within our banking group, CGD, which is particularly focused and active in these countries. So, putting the two conditions together, we achieved quite good growth in business arising from dealings with the Portuguese-speaking Countries in 2015, and we expect business in this segment to keep growing in the years to come.

Do you expect growth in business arising from dealings with Portuguese-speaking Countries to be as fast this year?

It’s difficult for any organisation to grow at 153 percent every year, but I also think that we are starting from a relatively low base, which also explains the higher growth we experienced in 2015.

How would you describe BNU’s position in connecting Chinese investors with Portuguese-speaking Countries?

BNU is a subsidiary of a Portuguese banking group, CGD, which is a state-owned institution. Hence, one of its missions must be to support Portuguese companies that operate in other places. We take this mission very seriously. It would be wrong to fail to take full advantage of the platform that our banking group has in Portuguese-speaking Countries. We are working hard to that end.

BNU and Bank of China Macau Branch signed in June 2015 an agreement to promote closer ties between Mainland China and Portuguese-speaking Countries. What is your assessment of this co-operative effort?

We have good communication with Bank of China, in particular with their team focused on this type of business. I think we complement each other well. The Bank of China has a strong presence in Mainland China, Hong Kong and Macao, and our banking group has a good presence in Portuguese speaking Countries. Our partnership has focused on getting customers on each side to talk to each other. For instance, when there’s a sizeable fair or exhibition in Macao, we work together to organise business-matching sessions among our customers. This is working quite well but there’s still a lot of room for future growth.

How can you increase such co-operation?

Above all, by following the policy of the Macao SAR and the Central Government of establishing Macao as a Commercial and Trade Co-operation Service Platform between China and the Portuguese-speaking Countries. The Macao authorities and the city’s institutions are now doing positive work to develop that line of business, so we should follow their directions and actions and use them as a way to develop our business. That does not prevent us from taking initiatives and dispatching missions of our own to promote growth in the business, which we keep doing.

You have headed BNU for more than five years. What is your take on the development of Macao’s banking sector?

Macao’s banking sector has had strong growth over the past year. In our case, the growth has been supported by business with not only local customers but also customers from the Portuguese-speaking Countries, which is still a relatively small part of our business. I’ve seen Macao’s banking sector grow significantly, although the growth has been dependent on business arising from dealings with Mainland China – the statistics are clear about that – and on the development of the RMB as a business currency. It’s been interesting to follow this growth.

Macao’s banking sector has had strong growth over the past year. In our case, the growth has been supported by business with not only local customers but also customers from the Portuguese-speaking Countries, which is still a relatively small part of our business. I’ve seen Macao’s banking sector grow significantly, although the growth has been dependent on business arising from dealings with Mainland China – the statistics are clear about that – and on the development of the RMB as a business currency. It’s been interesting to follow this growth.

What is your assessment of competition in Macao’s banking market?

Competition in the Macao market is quite healthy. Competition is always good because it helps us get stronger, so we can provide better products and services to our customers. When there’s no competition, the service tends not to be good.

Growth usually has a few obstacles in its way. How do you see the banking sector developing in the near future?

The business environment of Macao is well known to most companies and entrepreneurs. Owing to strong and rapid development up to the first half of 2014 – and owing to consolidation that has to some extent affected the tourism and gaming sectors – the Macao SAR’s economy has been going through a period of adjustment. This adjustment is expected to continue this year, although at a slower pace than last year. Overall, we remain quite positive about Macao’s overall growth prospects and potential, including the banking sector.

What are BNU’s growth objectives for 2016?

Our objectives for 2016 in terms of business and key performance indicators are more modest than in previous years. In view of the period of adjustment of the Macao economy, I think there’s also some impact in terms of business growth and quality of banking assets. I think the main factor in 2016 is much less demand for credit, not only by customers in the housing market – which is expected because of fewer transactions – but also by customers in the corporate segment. To be realistic, our hope is that the rises this year in our key performance indicators – but not all of them – will be in the higher single digits.