Search Issues

Doing Business in Czech Republic

The Czech Republic is one of the most successful transition economies in terms of attracting foreign direct investment. Over 130,000 Czech firms across all sectors are supported by foreign capital. Czech Republic is ranked 30 among 190 economies in the ease of doing business, according to the latest World Bank annual ratings.

The country possesses a well-educated workforce, advanced transport networks in Central and Eastern Europe, smooth business procedures, openness to international ownership and preferential policy for SME.

General review

The Czech Republic has been a member of the EU since May 2004, and has adopted the EU’s common external trade policy and measures. Its accession to the European Union in 2004 and the amendments to the investment-incentives legislation have further boosted investment. Since the 1990s the Czech Republic has welcomed numerous investors in various industries. Industries such as automotive, high-tech mechanical engineering, nanotechnology and advanced materials, aerospace, life sciences, ICT, business support services, pharmaceuticals and energy and environment are considered targeted sectors to stimulate the economic growth in the country.

Key Competitive Advantages

The Czech Republic is an attractive location for investment with the following reasons.

• Location in the centre of Europe, gateway to both eastern and western markets, less than two hours by air from most European destinations

• Creative, experienced and internationalized professionals at lower costs

• High degree of entrepreneurship and good conditions for doing business (above average within EU27)

• Regulatory and patent environment in accordance with EU standards

• One of the world’s most attractive places to live

• GDP per person by purchasing power parity – the highest in Central and Eastern Europe

• Well-developed infrastructure

Investment Incentives

Based on the Act No. 72/2000 Coll., investors who place or expand their investments in the Czech Republic can recieve support in the form of investment incentives. The Czech Republic offers both new and existing investors investment incentives and business support through several schemes. Investment incentives are available not only to investors launching or expanding production, but also to technological centres and strategic service centres.

Supported Areas

• Manufacturing Industry – implantation or expansion of production according to economic activity classification

• Technology Centres – construction or expansion of centres focused on research, development and innovation of advanced products, technologies and production processes; intended for use in production

• Business Support Services Centres – start or expansion of operations (shared-services centres, software development centres, high-tech repair centres, data centres and customer support centres (call centres)

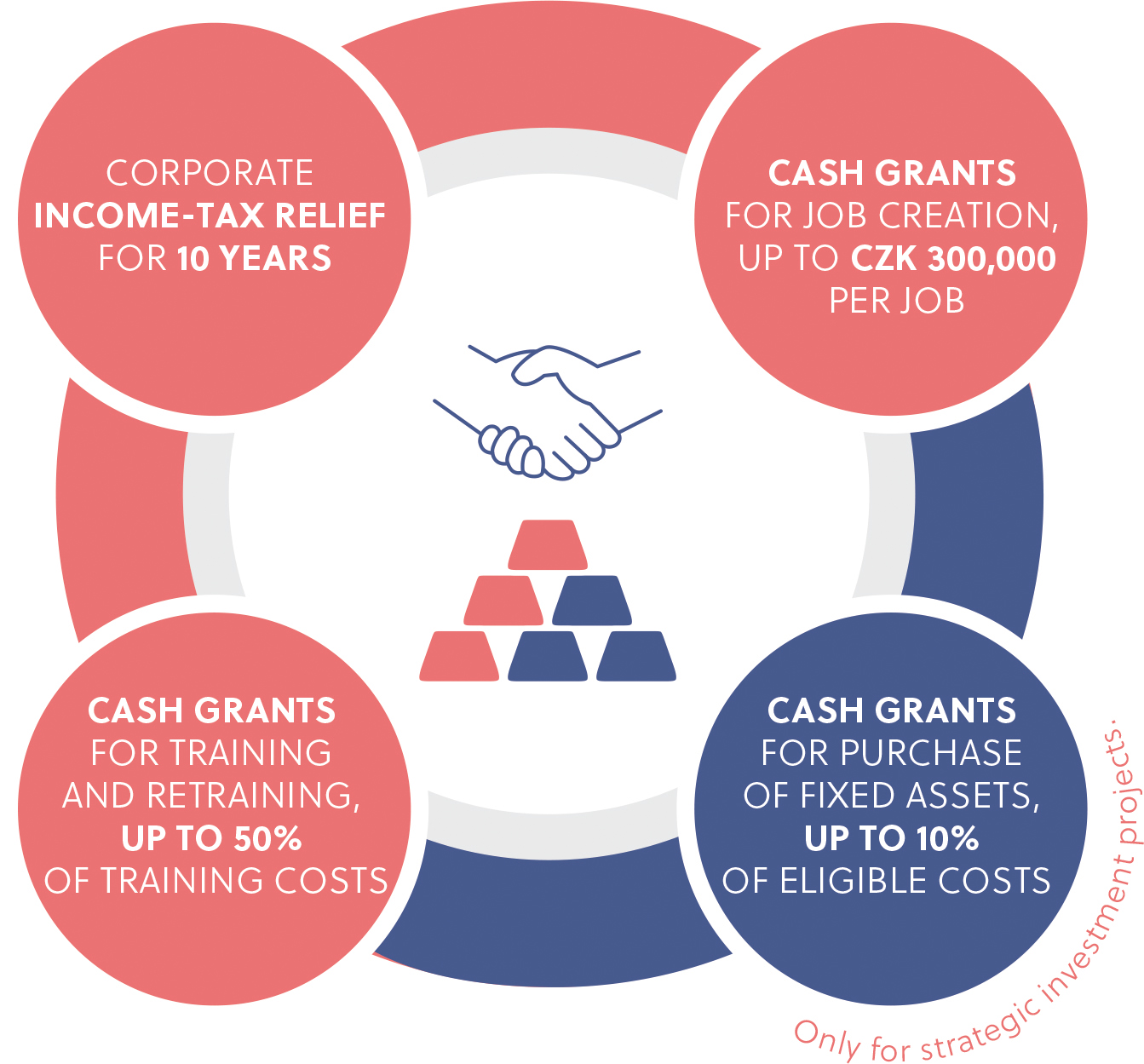

Forms of Investment Incentives

• Corporate Income Tax – Tax Relief for 10 years

• Cash Grant for job Creation, up to CZK 300,000 per job

• Cash grants Training and retraining, up to 50% of training costs for

• Cash Grants for purchase of fixed assets, up to 10% of Eligible costs

Taxation system

The current tax system in the Czech Republic was established in 1993. Taxes are divided into 3 basic groups – direct taxes, indirect taxes and other taxes. Since EU accession on 1 May 2004, the system has undergone a continuous process of harmonization with European legislation. The Czech Republic also has a broad network of double taxation treaties with both EU and non-EU countries. These double taxation treaties are based mainly on the OECD Model Tax Convention.

As from 1 January 2010, the standard corporate tax rate is 19%. A special tax rate of 5% is applied to certain collective investment funds and pension funds. Withholding taxes on income of non-residents 35/15/0%, according the type, the withholding tax rates may be reduced by double tax treaties.

Personal income is subject to a flat tax rate of 15%. The tax base for employees is calculated as the gross salary increased by the employer’s health insurance and social security contributions.

Source:

For more information and details regarding “Doing business in Czech Republic”, please visit the website at: https://www.czechinvest.org/en

For more tips on investing and trading in the EU, please contact the Business Cooperation Centre of Enterprise Europe Network Central China – Macao Office (EENCC Macao Office) at Tel: 2871 3338, 2872 7882/Fax: 2871 3339/Email: info@ieem.org.mo